Ride the market – or get a good night’s sleep?

The phrase ‘6 months forward sold’ seems to be on everyone lips right now. The unexpected residential property boom we’re in the middle of has seen double digit inflation return to the UK market and sales volumes that few people predicted as we started 2021 in the grip of the Corona Virus pandemic with the spectre of the BREXIT fallout to follow.

Despite the bullish end to 2020, who would have guessed how the year was going to turn out back in the spring, certainly none of the big names in the business – even as late as March, Savills were only predicting a modest 4% inflation rate. (For my part, I offered up three different possible outcomes, cautious maybe, but at least I predicted the best of them would show as much as 10% growth for the best locations.)

The world looked very different back in January. Despite the vaccination programme getting underway, the third lockdown started on January 5th, schools included, death rates continued to climb and there seemed no end to the misery. On the property front, the Stamp Duty holiday was due to finish in March and thousands of buyers were complaining that delays in the system would mean that they would miss the deadline and incur thousands in extra tax.

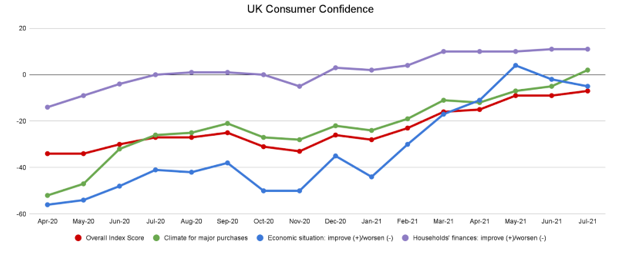

But the British public simply refused to be bowed by all this bad news. The wonderful GfK/NOP Consumer Confidence survey reflected a growing, if misplaced optimism that really got its running shoes on in January and has not let up since.

Source GfK/NOP

Indomitable British Spirit! Who would have believed these numbers? Despite the pandemic, lockdowns, furlough, BREXIT and all, the public’s confidence in the UK economy grew by almost forty index points in between January and July 2021. The climate for major purchases a car, a kitchen, a home improved from minus 22 to plus 2 over the same period – extraordinary.

From March, it’s been pretty much a never-ending stream of good news – comparatively speaking. First, the chancellor saved the hard-pressed homebuyers who couldn’t get their completions done in time to meet the Stamp Duty deadline by extending it to the end of June and then tapering the reduction by 50% with the final closure of the scheme being delayed until the end of September. The extraordinary vaccination programme finally broke the link between infections, hospitalisation and deaths, so we began to see a path out of the nightmare and caught glimpses of the sunny uplands beyond.

At the same time, rush-hour commuters in cities across the country embraced the concept of working from home, exchanging the torture of packed, sweaty trains and outrageous season-ticket prices with the joy of holding meetings in the spare room without even having to dress from the waist down. All they needed was a spare room and a decent broadband connection – and a garden was a bonus.

Homebuyers responded with gusto. The paltry maximum £15K saving on stamp duty was soon swallowed up by rampant house price inflation fast heading for double digit growth, but it didn’t make a scrap of difference. Properties were being snapped up within hours of coming onto the market, offers were being made above asking price. By June, the ever-reliable Nationwide index was showing 13.4% inflation year on year.

So how did the builders react?

They took advantage of the increased selling prices, obviously, but in most cases, not to the same extent as the second-hand market. Because these market conditions throw up a tantalising prospect, the ability to move the business into a long forward-sold position, to de-risk the next six months, to make the bankers happy, and the investors, and the shareholders, and the board of course. But does that make it the right decision?

In a market of under-supply and over-demand, developers will invariably always be able to sell everything they build – allowing for the natural capacity of any area to absorb additional housing stock of course (if you built 1,500 new homes next year in Budleigh Salterton, it might take more than a week or two to sell them all) – but by adjusting their asking prices they can dictate sales rates. Needless to say, having five HBF stars, a brand that buyers know and love, a product that appeals and a reputation that breeds confidence, sets that price bar higher, but wherever the baseline is, there is still the option to tweak the price with the consequent effect on sales rate.

The late, great Frank Eaton once said to me, “the only time I’ll ever sleep easy is when every [Barratt] region is six months forward sold”. With great respect to one of my heroes in the industry, I’m not sure I agree. In my early days in the business, an aspiring Sales Director would get just as big a roasting if he or she sold out a release in a weekend as if they had got no sales at all – “you sold ‘em too cheap!”

In the current market, six months of inflation could be worth anything up 6% or 7% on bottom line, but money in the bank has a special appeal, it’s real, not just the ephemeral hopes and aspirations of the sales team. If that’s what it takes to make the money men happy then so be it, but I see that as an opportunity to some of the smaller more agile operators to take advantage. And, if your competition across the road can’t offer your prospect a plot for six months or more, then it makes your product more desirable still.

This febrile market is fragile, no question. I am quite certain the double-digit headline numbers will last no longer than two or three months, so care is required. But I’m equally certain that on some sites there’ll be the opportunity to ride these market conditions and see some real margin growth. Make sure all the early warning KPI’s are in place and move fast if the market dictates.

The question is, can you bear the thought of a few sleepless nights for the prospect of another 5% on net margin? There’s always Nytol.